best cheap stocks to sell covered calls

WMT Acadia Healthcare Co NASDAQ. Free strategy guide reveals how to start trading options on a shoestring budget.

Call Option Understand How Buying Selling Call Options Works

Lower Share Prices.

. In March 2022 the company announced that it will run. To give you an idea of how high it is here is the implied correlations for other ETFs at that time. The premiums arent gigantic but if the stock isnt called away then that premium you just sold could be.

When traders make a case for selling long-term options against their stock positions they usually argue that the long-term approach gives them. We ran the numbers and got an implied correlation of 76 for the 2 year options. A long call is wayyy cheaper than 100 shares nearly any portfolio size can do this.

REITs also if you tryna sell to wsb but still garbage. 128 call for a net debit of 495. Given all of this information we can calculate what the implied correlation of the ETF is.

Ive got about 100k to work with and Id like to start selling covered calls. Lorillard LO is a tobacco company with a nearly 16 billion dollar market cap that has consistently raised its dividend by. 1 on 1 Training.

For a free trial to the best trading community on. Electronics retailer has fended off e-commerce threats and its still growing. The stock just entered a.

Covered Calls Advanced Options Screener helps find the best covered calls with a high theoretical return. Instead of just Buying Stock to Sell CCs start earlier in the process - Lets take your AAPL as example currently trading at 13537 - Right now you can Sell a Cash Secured Put on AAPL w Mar 05 expiry and 132 Strike for 200 - If AAPL makes it to Mar 05 without dipping to 132 Strike great you just made 200 and are ready to go again - if it does dip and you get assigned great. Global X Nasdaq 100 Covered Call.

XOM EXXON MOBIL CORPORATION In our first covered call example XOM has trade between 72 and 88 over the past two years and is currently in the middle of that zone around 80. Worlds biggest package delivery company. But you should be aware that dividends do play a role in call option pricing.

Best Stocks for Covered Calls. I was thinking maybe Shopify would be a good contender but Id have to put all my money in just to sell one call and having all my money is single stock that is as volatile as. In the slide below you can see in the circled section I give exact details on the prices you are likely to pay for the stock and the price for the call sale.

Ive got about 100k to work with and Id like to start selling covered calls. Obviously if the stock is a 50 stock you must pay 5000 to buy the stock as opposed to only 1000 for a 10 stock. The Feeble Argument for Long-Term Covered Calls.

Ad Learn How To Spot Ideal Times For Covered Calls. Basically buy a LEAP itm call and sell short term slightly otm calls on it until it expires. In theory on the day a company pays a dividend the stock should trade lower by the amount of the dividend because that money is no longer owned or controlled by the company.

I used my favorite stock screener to find this high momentum yet great value. Berkshire stock may be the perfect stock for covered calls. Learn More In A Free Video.

Manufactures automobiles under its Ford and Lincoln brands. When selling covered calls I generally recommend selling on 13 to 23 of you position. Lets get started today.

Cost of your call has to be strike price difference premium received from the short call. AMAT FCX GLW GPS SPLS VLO and. Best Stocks for Covered Calls.

For example Consolidated Edison ED. Less hassle and stress than actively day trading which is too time consuming. Best Wheel Stocks Under 10 Wheel Strategy.

Such scans are customizable at least to the extent of the preset query. Recon Capital NASDAQ-100 Covered Call ETF. Sell the Jumia 15 November puts for 3 using GTC order.

This video will tell you my best stock to sell covered calls for in June 2021. You must own at least 100 shares of a stock to write one covered call. Weed stocks are all cheap and garbage but lots have weeklys and decent IV ACB APHA CRON and always get IV runups pre earnings but you need the stomach to bag hold garbage weed stocks similar with a lot of pharma stocks except you better have a stomach of steel for those to sell covered calls pre trial.

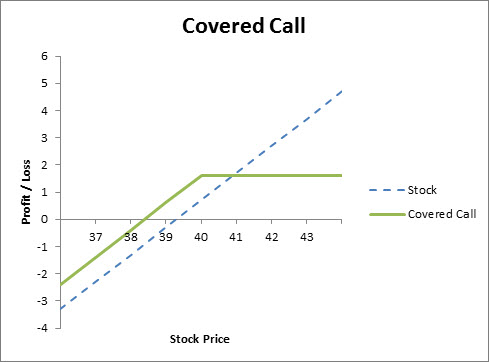

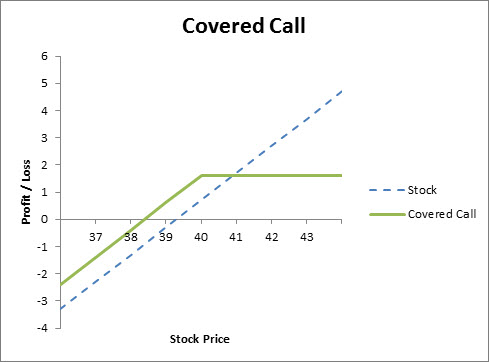

Sell the Jumia 15 November puts for 3 using GTC order. A Covered Call or buy-write strategy is used to increase returns on long positions by selling call options in an underlying security you own. And then selling covered calls on the 100 shares that you own.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Omega Healthcare Investors yields 69 today and its dividend is well covered by the rents of its tenants who operate skilled nursing facilities. Eaton Vance Enhance Equity Income Fund II.

In addition to being promising covered call candidates many of these stocks are trading at compelling valuations. If youre in a hurry below are our top picks for the best stocks for covered call writing. There are websites that allow you to scan the market for the highest-returning covered call trades and to include fundamental data points in the scans query parameters as well such as PE ratio market capitalization and earnings per share.

Best stocks under 1100 to sell covered calls. Amplify Advanced Battery Metals and Materials ETF. When traders make a case for selling long-term options against their stock positions they usually argue that the long-term approach gives them.

Ad See the options trade you can make today with just 270. Which is VERY high. Best stocks under 1100 to sell covered calls.

You sell short a call option against that stock 1 option controls 100 shares. F Ford Motor Co. This makes OPKO a.

120 call while selling the Aug. United Parcel Service NYSE. Ad Were all about helping you get more from your money.

These are two dividend stock examples that are some of the best stocks to write covered calls against. Jumia is almost flat on the RSI and MFI is showing a divergence upward that signifies developing volume strength. Credit Suisse AG - Credit Suisse X-Links Crude Oil Shares Covered Call ETN.

Good stocks to write covered calls against include those whose stock price is between 5 and 20 a share. If risk of a downturn is high trim some of the stock position outright at. For example lets say that the XYZ Zipper Company paid a 050share dividend on June 1.

When I send a trade alert at Cabot Options Trader I give detailed instructions on how to execute the trade. The IV of the ETF itself.

Covered Call Strategies Covered Call Options The Options Playbook

10 Options Strategies To Know Option Strategies Stock Options Trading Strategies

An Alternative Covered Call Options Trading Strategy

What Is A Collar Position Fidelity

/10OptionsStrategiesToKnow-01-10080bc58b164d78b262547662532504.png)

10 Options Strategies Every Investor Should Know

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Anatomy Of A Covered Call Fidelity

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Put Option Vs Call Option When To Sell

Covered Call Options Covered Calls Call Option Safe Investments

7 Best Options Trading Examples 2022 Benzinga

What Is A Collar Option Strategy Corporate Finance Institute

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

Naked Call Writing A High Risk Options Strategy

Agree Or Disagree Market Risk Value Investing Futures Contract

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Wedding Budget Worksheet Free Download Excel And Google Sheets Options Trading Strategies Call Option Trading Charts